- Home

- How to refund only the tax amount to a customer

If you have to refund a complete invoice, you can do it with a credit memo, where you´ll be returning the complete purchase, taxes included.

But, if you need to refund only the tax amount, because that customer is exempt, or whatever the reason is, you can not do it by “adding” a credit memo from that invoice as is the usual process.

In this case, you need to create a new credit memo only to refund this amount.

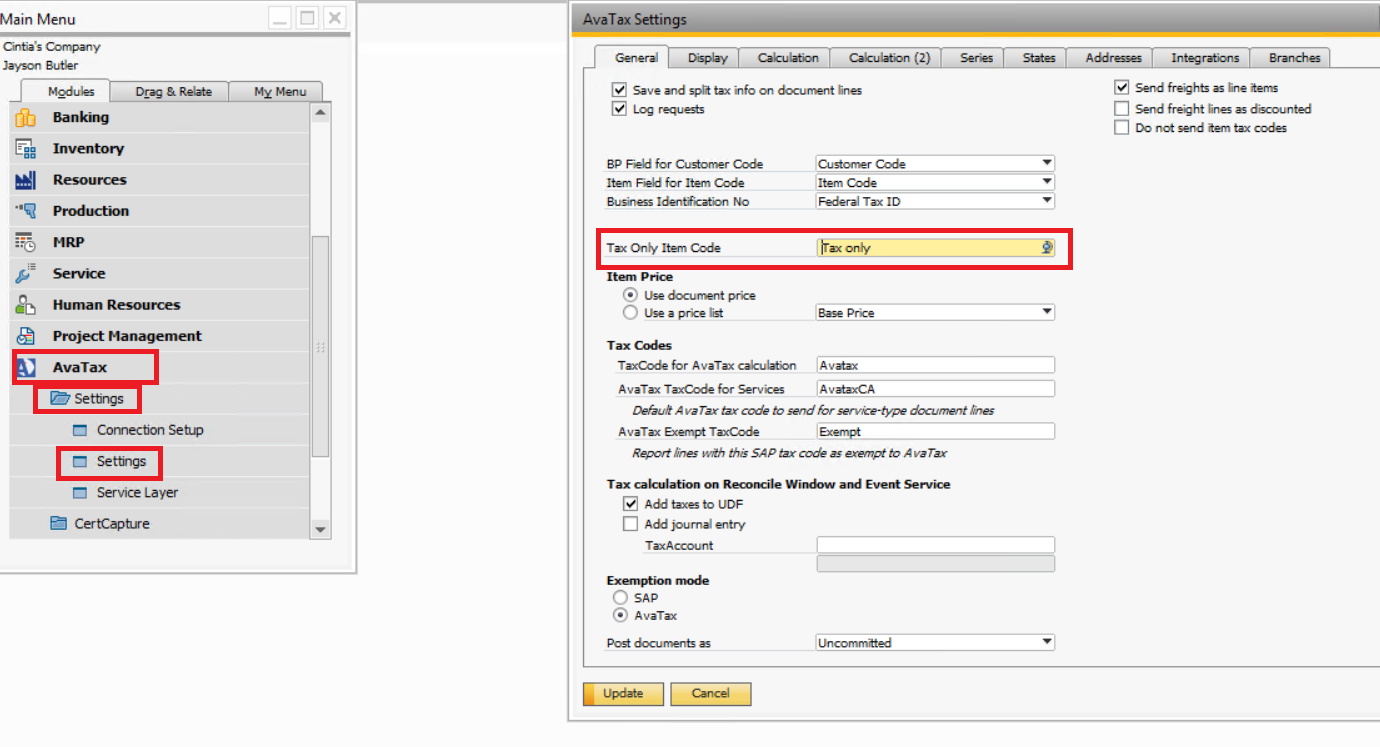

Before doing this, you need to create a unique code, it will be created in your Avatax module, settings, settings. See screen below

There, you need to create a term that will be identifying this transaction whenever you need to do it. For example, in the screen above, the code “Tax only” was created for this purpose. This code will be used as an item code in your credit memo when you need to refund a tax amount.

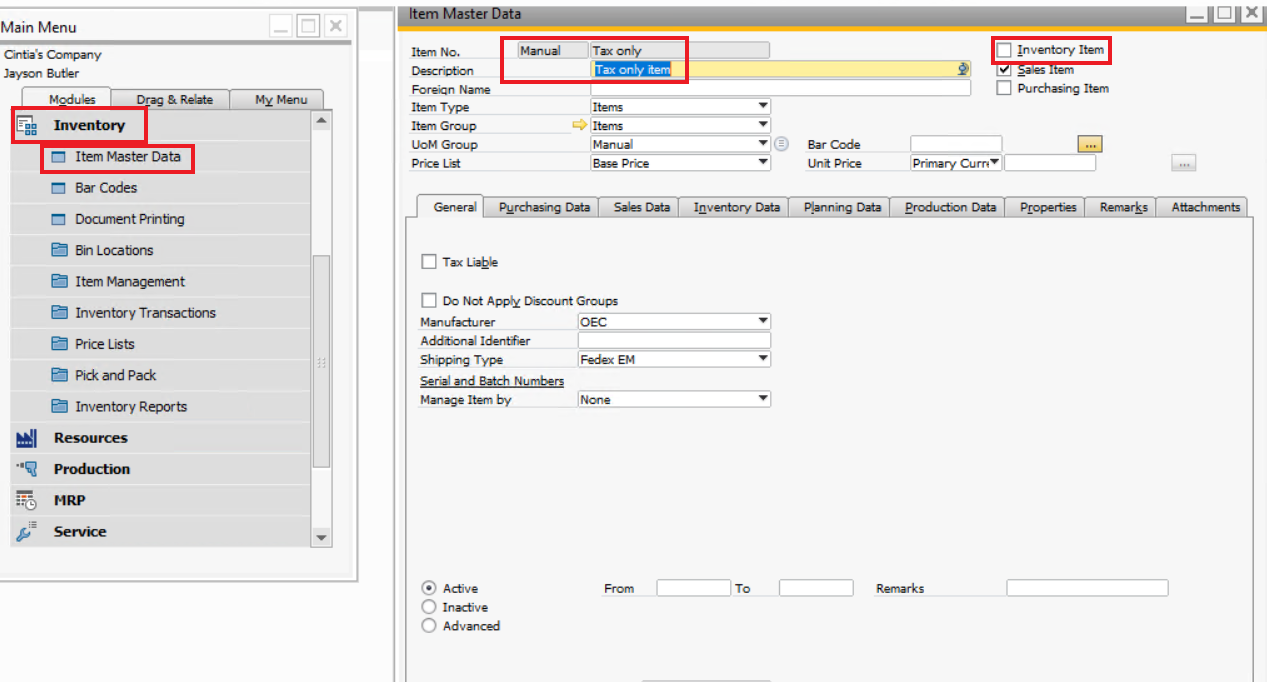

Then, you need to create the same item in your Item Master Data as shown below, respecting uppercase and lowercase letters, exactly the same name as the one created in the previous step. Keep in mind always to uncheck the “inventory item” checkbox.

Those two steps described above are one-time tasks. Once the “tax only item code” and the “item” are created, you won’t need to repeat these steps.

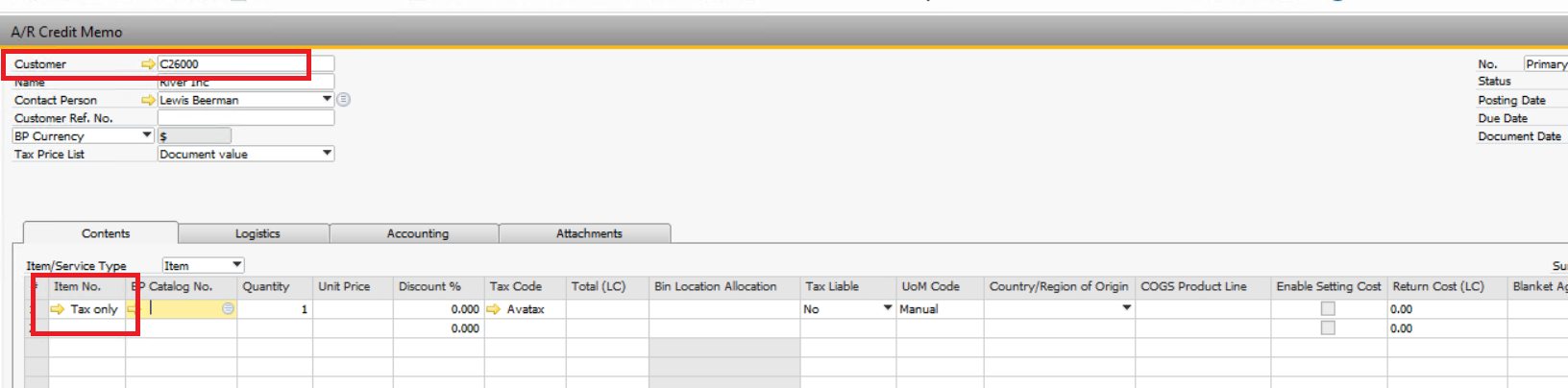

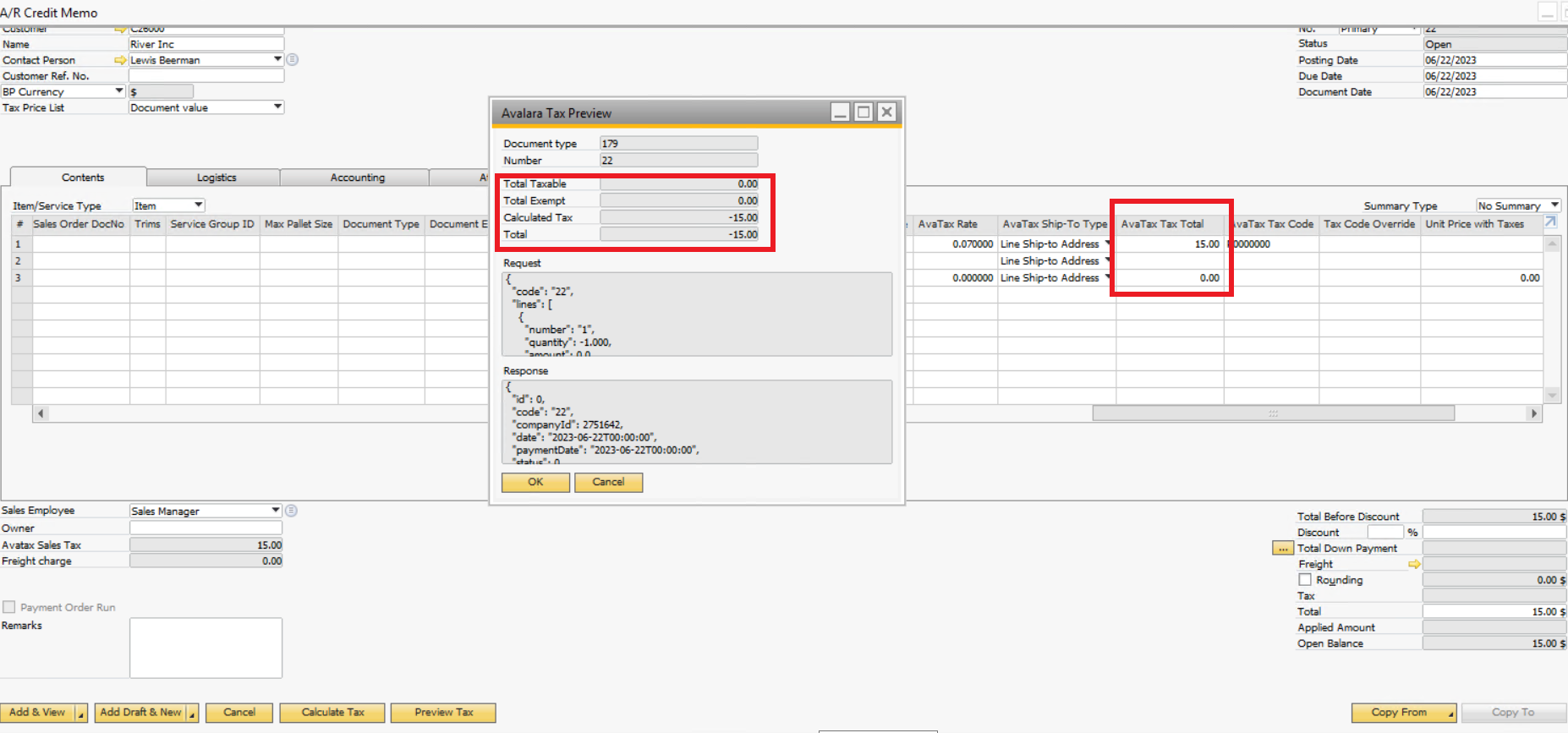

Then, go to create the new credit memo, complete with the customer code which you need to refund, add as an item the new item created, “Tax only” following our example, complete with the amount of the taxes that you need to refund, you have to fill it out manually in the “Avatax Tax Total” column. Finally, press “preview tax” and add this new document.