In this tab, you will find more customized features in case you need it.

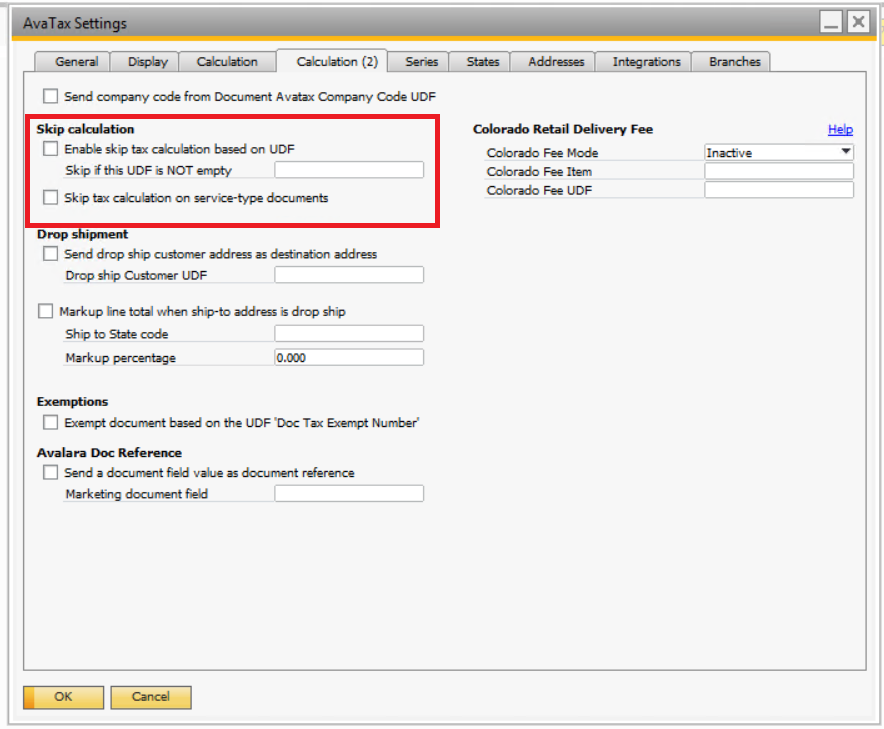

Skip calculation

- Enable skip tax calculation based on UDF. Skip if this UDF is NOT empty:

If you design a UDF in this field, every time Avatax reads this UDF with some info (not empty) it will skip the tax calculation

- Skip tax calculation on service type documents: the same functionality but when you create a document of services, not products.

Colorado Retail Delivery Fee

Colorado has special regulations, in case it applies to your business, you should check this information by following this link http://www.axapsolutions.com/en/node/52, and you will configure it in this tab

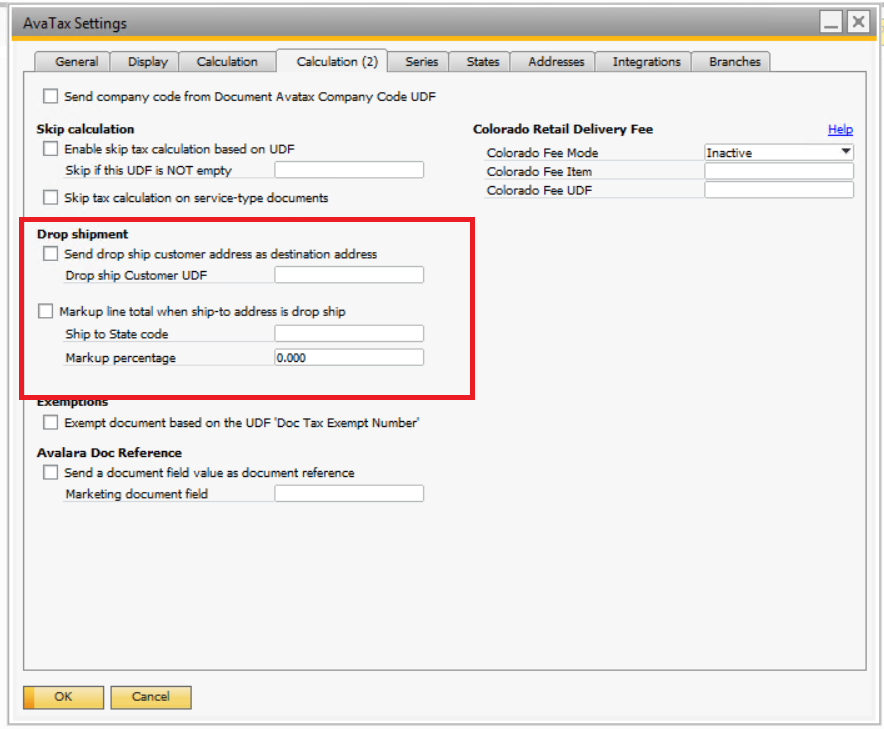

Drop shipment

- Send drop ship customer address as destination address. Drop ship Customer UDF:

If you want that the products you are selling go directly to the address of a customer as the destination address, you should fill out this UDF to identify those cases and make this customization of the drop shipment possible.

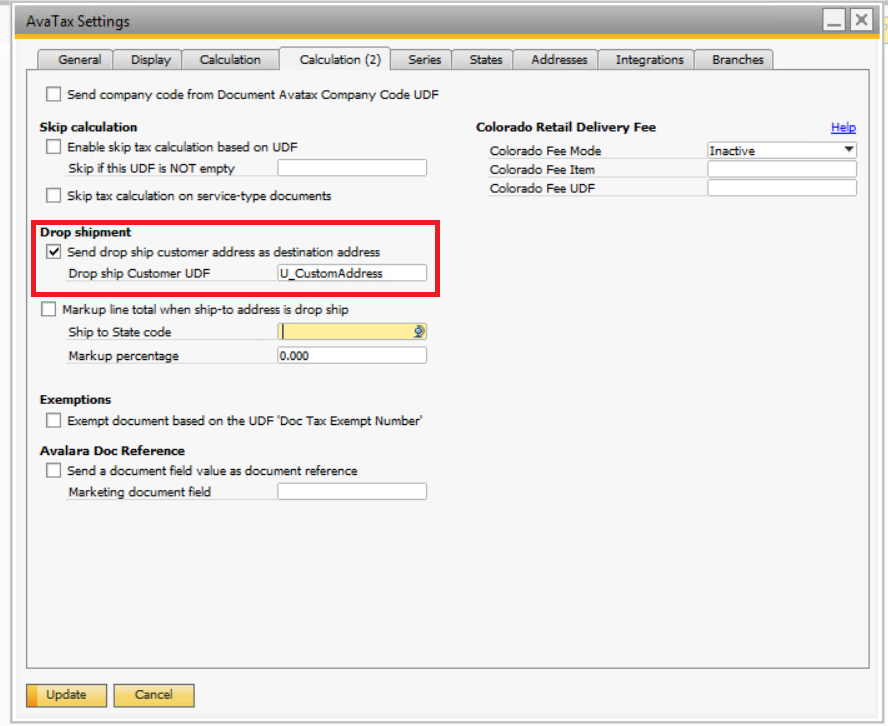

See the image below as an example

- Markup line total when ship-to address drop shop. Ship to State code. Mark up percentage.

This option allows to configure the markup percentage over the document lines when the sale is a drop ship in a specific ship-to state.

For example in the state of California, it’s required to calculate the taxes based on the sale taxable amount plus 10%. Meaning the resulting tax amount for the document will be calculated based on the document total plus 10%, while the document total before tax will remain the same in SAP.

To configure this, you have this section:

You can enable or disable the functionality by using the Markup checkbox.

Markup will be applied for a specific ship-to state, in this sample is CA (California). Always use the 2-digit code for the state, as configured in SAP.

The Ship-To state is evaluated by each line to apply the markup, so pay attention to the Avatax Ship-To Type UDF at the document line level, where you specify the Ship-To to be considered for the line (Document Ship-To, Line Ship-To, Branch or Warehouse).

The markup percentage is also configurable, in the screenshot is 10%.

Finally, you must previously configure a Ship-To Destination address as Drop-Ship or not. This is done using a new UDF: CRD1.U_ARGNS_DROPSHIP

The markup will only be applied when all conditions are true:

- The markup functionality checkbox is checked.

- The ship-to address has the U_ARGNS_DROPSHIP set to Yes at the Business Partner master record.

- The ship-to state of the address matches the configured ship-to state in the settings for the markup calculation.

When posting the document to AvaTax, you will get the document committed with the extra markup applied over the matching lines.

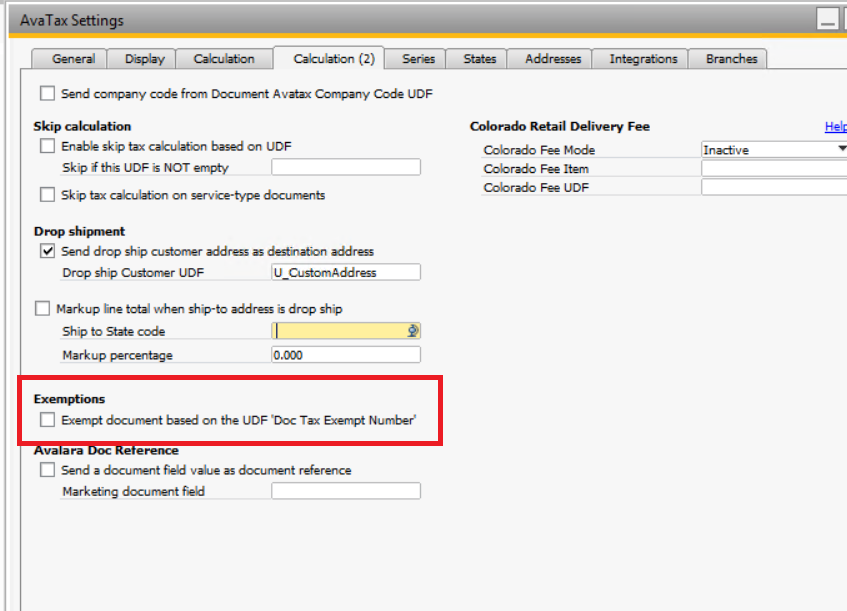

Exemptions

- Exempt document based on the UDF Doc Tax Exempt Number:

This is intended for customers who want to exempt specific documents on isolated cases, without marking customers or addresses as exempt.

A setting is available to turn the function on or off. If it’s disabled, then the UDF will be ignored.

The UDF U_ARGNS_TAXEXNUM is generated at the Document Header Level:

If the UDF is empty, then will be ignored. If has a value, that value will be sent as an exemption number to Avalara (it doesn’t consider the add-on exemption mode).

Avalara Doc Reference

- Send a document field value as a document reference. Marketing document field:

For Sales Document Header field value, SAP native or UDF, as a Reference when sending the document to Avalara.

The value is sent in the Reference field of the Avalara transaction, and it’s visible from the Avalara web console.

If you intend to use this feature, you must check the box to enable it and complete the marketing document field name you intend to use.

You can use a native field, for example, NumAtCard, or a UDF for example U_Test. Keep in mind the field must exist at the marketing document header level, and that, in HANA, is case-sensitive about field names.